WalletHub analysis of US Census Bureau data show that Texas and Florida have 11 out of the top 25 fastest growing cities over the past decade.

Personal musings on history, housing, technology, society and finance... Not necessarily in that order.

Wednesday, October 14, 2020

Tuesday, October 13, 2020

Zillow: Latinx Americans are Driving U.S. Homeownership Gains, But Wide Gaps Remain

Zillow recently investigated Latinx American home ownership using data from the Federal Reserve Board Survey of Consumer Finances. On a positive note, we're seeing the highest share of Latinx households owning their homes since 2008, although a wealth disparity remains. What jumped out at was a chart showing the share of net worth held in the homes of Latinx, as well as Black, homeowners - 1.69x and 1.46x greater than white home owners respectively.

The economic well-being of these folks are significantly more exposed to changes in home values. We may well be in for a likely bumpy ride ahead for housing in post-forbearance 2021, especially in the lower end, where the home owners have been hit harder and have less in built-up home equity.

Friday, October 9, 2020

LinkedIn migration data

Cities with the highest relative levels of net migration based on changes in LinkedIn profiles over the last twelve months. It’s Austin by a mile, 50% higher than runner-up Charlotte. Thematically, towards the Southern/Mountain states and away from the coasts with Seattle being the sole outlier.

Oh great and holy LinkedIn, can you reveal to us the truth about the change in velocity of migration over the past twelve months? Just asking...

Thursday, October 8, 2020

WSJ: Where Trump and Biden Stand on Mortgage Finance

Figuring our what to do with Fannie Mae and Freddie Mac "remains the largest single piece of unfinished business from the 2008 financial crisis." Both are under Federal Housing Finance Agency conservatorship, recipients of about $200 billion in government bailout to prevent failure during the mortgage crisis at the time. Since then, the two agencies have sent back over $300 billion in the form of dividends to the U.S. Department of the Treasury. #housing #mortgage #housingmarket #realestate #homeownership

State of play: US commercial real estate 3Q20

State of play in commercial real estate across six key US cities courtesy of Savills. All 3Q20 data except for Dallas where I used 2Q20 data.

Some observations:

- Leasing activity fell like a rock as expected. Deep freeze in SF while Manhattan's drop was surprisingly the lowest in the peer set.

- While asking prices did not weaken more than you'd imagine, the sublease share of available inventory in SF (52%) and Manhattan (27%) has gotten, um, substantial.

- I'm frankly surprised at LA's performance given the state's covid lockdowns. Of course, it's hard to generalize given the heterogeneity of the market.

- Dallas, and Houston to a lesser extent, seem to be the overachievers in this peer set. Anecdotally, I've seen less of a discontinuity in commercial development in DFW. There have even been a number of new restaurants that recently opened.

Saturday, October 3, 2020

Forbearance: A rather miniscule "jump," but wait, there's more...

- While the overall rate is 6.8%, over 11% of FHA and VA loans are in forbearance. The Fannie and Freddie contingent is now under 5%.

- Over 3 out of 4 loans in active forbearance had their terms extended at some point since March.

Thursday, October 1, 2020

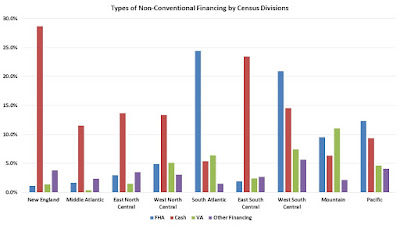

Regional differences in the financing of new home sales

The National Association of Home Builders analysis of the 2019 U.S. Census Bureau Survey of Construction data shows that the share of non-conventional (i.e., Fannie Mae and Freddie Mac mortgages) financing for new home sales accounted for 35%, up from 29% in 2018.

Eye-opening is the level of significant regional differences. Of particular note, nearly one in ten new homes in New England were purchased with cash. Given the level of mortgage rates, why is this cohort of home purchasers resorting to cash (or equivalent)? Is this an indication of a product-market mismatch?